One of the most common questions homeowners ask after these incidents is, “Will Insurance Cover The Cost Of Temporary Repairs To Prevent Further Damage?”

As a homeowner in Knoxville, TN, unexpected weather can bring challenges, especially when it comes to roof damage. Whether it’s heavy winds, hailstorms, or falling trees, roof damage can happen in an instant, leaving your home vulnerable to further destruction.

Understanding how insurance companies address temporary repairs is vital, as it can save homeowners from costly future repairs. In this article, we’ll dive deep into how insurance coverage works in such situations, what types of temporary repairs are typically covered, and the steps you should take to ensure your insurance claim is approved.

Why Temporary Repairs Are Important

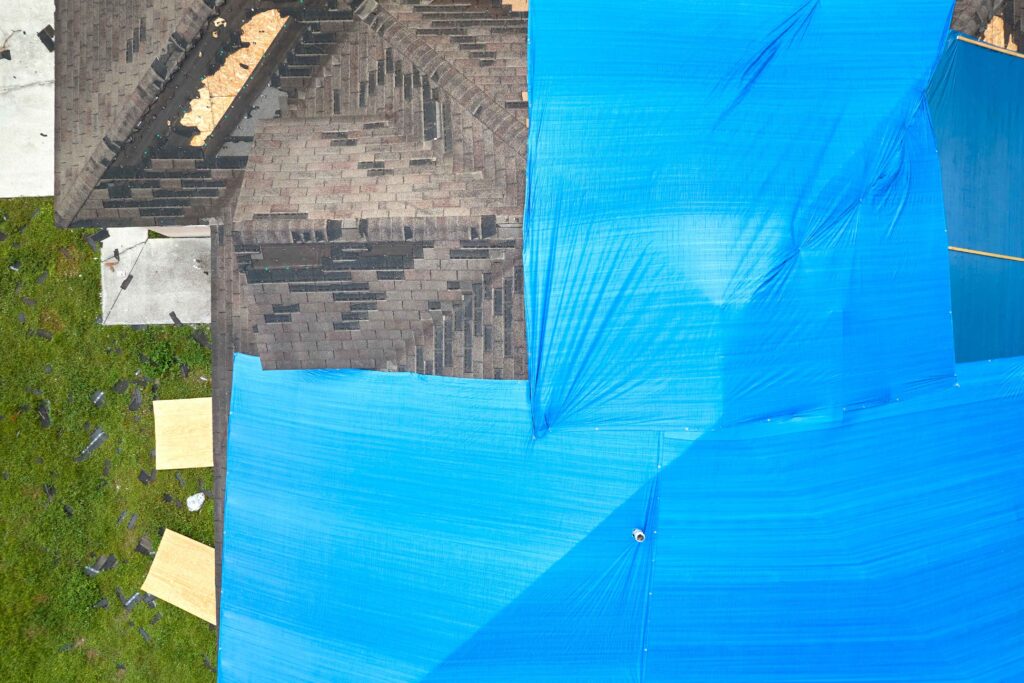

Temporary repairs play a critical role in safeguarding your home from additional damage after an initial incident. For example, if a tree branch falls and creates a hole in your roof, temporary measures like tarping the roof can prevent rainwater from entering and causing water damage to your ceilings, walls, and furniture.

Failing to make these immediate repairs can lead to higher expenses later. Thus, many insurance companies encourage homeowners to act quickly and make these temporary fixes.

Will Insurance Cover The Cost Of Temporary Repairs?

The short answer is, yes, most homeowners’ insurance policies will cover the cost of temporary repairs to prevent further damage. However, it is essential to understand the specifics of your insurance policy. Generally, insurance companies expect homeowners to take steps to mitigate damage. If you don’t take immediate action, the insurance company may reduce the amount of your claim or even deny it entirely.

When dealing with temporary repairs, the question “Will insurance cover the cost of temporary repairs to prevent further damage?” becomes vital. It’s important to know when and how your insurance policy applies in these cases.

Key Conditions to Keep in Mind:

– Documentation: Insurance companies usually require documentation of the damage before and after temporary repairs are made. This could be photos, videos, or even written estimates from professional contractors.

– Reasonable Repairs: The term “reasonable” is crucial in insurance language. Insurance will generally cover only the costs that are considered reasonable for preventing further damage. Extravagant or unnecessary repairs may not be covered.

– Prompt Action: Most policies require that homeowners act quickly after the damage occurs. Delaying temporary repairs may result in the insurer refusing to cover subsequent damage.

Common Types of Temporary Repairs Covered by Insurance

Temporary repairs can range from simple DIY fixes to professional interventions. Some of the common temporary repairs that may be covered by your insurance policy include:

- Roof Tarping: If a storm creates a hole or tear in your roof, tarping it can prevent further water damage.

- Boarding Up Broken Windows: After high winds or flying debris, broken windows can let in rain or even intruders. Boarding up windows is a necessary temporary repair.

- Water Extraction: If water leaks into your home, quick water extraction can prevent mold growth and structural damage.

- Bracing Walls or Ceilings: If your home suffers structural damage, temporary braces can help stabilize the area until permanent repairs are made.

- Plumbing and Electrical Fixes: For minor leaks or electrical hazards caused by storm damage, a quick fix can prevent water damage or fire risks.

How to Ensure Your Temporary Repairs Are Covered

Now that we’ve addressed the question, “Will insurance cover the cost of temporary repairs to prevent further damage?”, let’s look at how you can ensure your claim is approved.

Read Your Insurance Policy

Not all insurance policies are the same, so it’s critical to review your own policy to understand what is covered. Pay special attention to the section on “mitigation of damage,” as this will outline your obligations after a loss.

Call Your Insurance Company Immediately

Once the damage occurs, contact your insurance company right away to inform them. They may guide you on the steps to take and provide advice on the temporary repairs needed.

Document Everything

Before you start making repairs, take detailed photos and videos of the damage. This documentation will serve as proof when filing your claim. After making the temporary repairs, document the work done, including receipts for any materials or professional help you hired.

Work With a Reputable Roofing Contractor

If your roof has been damaged, it’s wise to consult with a licensed roofing contractor in Knoxville, particularly one experienced in working with insurance claims. They can often help you understand what temporary repairs are necessary and what will likely be covered by insurance.

The Importance of Choosing a Local Roofing Company

When dealing with roof damage in Knoxville, TN, it’s a good idea to work with a local roofing company. Local contractors understand the common weather-related damages in your area, are familiar with insurance policies in Tennessee, and are readily available to provide immediate assistance.

Additionally, Knoxville roofing companies typically have better relationships with local insurance adjusters, which can expedite the claims process.

FAQs: Will Insurance Cover The Cost Of Temporary Repairs?

Temporary repairs are short-term fixes that prevent further damage until permanent repairs can be made.

Yes, as long as the repairs are reasonable and necessary to prevent further damage.

No, most insurance companies recommend making immediate temporary repairs to prevent further damage.

Your insurance claim could be reduced or denied if you fail to act promptly.

Yes, insurance will only cover repairs deemed reasonable and necessary.

Take photos, videos, and save receipts for all materials and labor.

Yes, insurance typically covers professional services if needed for the repair.

Yes, your deductible will apply to the overall claim, including temporary repairs.

The insurance company may still cover additional damage, provided you took reasonable steps.

Understanding Temporary Repairs

Understanding “Will insurance cover the cost of temporary repairs to prevent further damage?” can save you both time and money during stressful times. By acting quickly, documenting everything, and working with your insurance provider and local roofing contractors, you can ensure that your home remains safe and that your roof repairs are covered.