When your roof sustains damage, one of the most pressing concerns is determining whether your homeowner’s insurance policy will cover the cost of repairs.

Roof damage can result from a variety of causes, including storms, fallen trees, hail, or even gradual wear and tear. Understanding the scope of your insurance coverage is crucial to avoiding costly out-of-pocket expenses.

In this article, we will walk you through the factors that determine whether roof damage is covered by insurance and how to navigate the claims process effectively.

Key Takeaways

💡Insurance Covers Sudden Damage, Not Wear and Tear

💡Policy Type and Exclusions Matter

💡Filing a Claim Requires Proper Documentation

💡Insurance Claims Can Affect Future Costs

Types of Roof Damage That May Be Covered by Insurance

Insurance policies typically cover sudden and accidental roof damage caused by external forces. However, not all types of damage will be eligible for coverage. Let’s break down the most common causes of roof damage and whether they are likely to be covered.

1. Storm Damage (Wind, Hail, Rain)

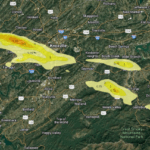

Wind and hail are among the most common causes of roof damage that are covered by homeowner’s insurance. High winds can tear off shingles, while hail can cause dents or even puncture the roof. If your roof is damaged by a storm, your policy likely covers repairs, especially if the storm is documented as a significant weather event in your area.

2. Falling Objects (Trees, Debris)

Damage caused by fallen trees or large debris is typically covered by standard homeowner’s insurance policies. However, the cause of the fall matters. If a tree fell because of a storm, you’re more likely to be covered, but if the tree was dead or rotting and fell due to neglect, insurance may deny the claim.

3. Fire and Lightning

Fire or lightning damage is almost always covered, as these are considered catastrophic events that cause sudden destruction.

4. Water Damage

If water damage occurs due to a hole or opening in your roof caused by a covered event (such as a storm), your insurance will typically cover the damage. However, slow leaks caused by poor maintenance may not be covered.

5. Roof Damage Due to Wear and Tear

Normal wear and tear, such as aging shingles or minor leaks, are not covered by insurance. This type of damage is considered a maintenance issue, and you are responsible for repairs or replacements due to general roof aging.

Understanding Your Insurance Policy

To determine whether your roof damage is covered, it’s important to understand the key aspects of your homeowner’s insurance policy:

1. Named Perils vs. All-Risk Policies

Named perils policies cover only specific types of damage, such as wind or hail. If your roof damage was caused by a peril not listed in the policy, your claim may be denied. All-risk policies, on the other hand, cover a wide range of damages unless explicitly excluded in the policy.

2. Exclusions and Limitations

Some insurance policies may exclude certain types of roof damage, such as damage from hurricanes or earthquakes, unless you purchase additional coverage. For instance, roof damage caused by flooding may require separate flood insurance.

3. Deductibles

Every insurance policy includes a deductible, the amount you must pay out-of-pocket before your insurance kicks in. Make sure to understand how much your deductible is for roof damage claims. Sometimes, policies have a separate, higher deductible specifically for wind or hail damage.

4. Age of the Roof

Many insurance companies consider the age of your roof when determining coverage. If your roof is more than 20 years old, insurers may limit the payout to the actual cash value (ACV), which takes depreciation into account, rather than covering the full replacement cost.

Steps to Take When Filing a Roof Damage Insurance Claim

Knowing how to file a claim is essential to ensure you maximize your chances of getting your roof damage covered.

1. Document the Damage

As soon as you notice damage, take pictures of the roof and any interior damage caused by leaks. Make sure to capture all details, including missing shingles, cracked tiles, or water stains inside the home.

2. Contact Your Insurance Company

Notify your insurance provider as soon as possible. They will guide you through the next steps and send an adjuster to inspect the roof.

3. Get a Professional Inspection

Have a qualified roofing contractor assess the damage and provide a detailed estimate for repairs or replacement. Their expert opinion can help strengthen your claim.

4. Mitigate Further Damage

You are responsible for taking steps to prevent additional damage while waiting for repairs. This may involve covering the roof with a tarp or temporarily fixing a leak.

5. Work with the Insurance Adjuster

The insurance adjuster will assess the damage and compare it to the terms of your policy. Be sure to provide them with all documentation, including photos, estimates, and any receipts related to temporary fixes.

6. Review the Claim Offer

Once the adjuster has evaluated the damage, they will make a settlement offer. Review this carefully, and don’t be afraid to negotiate if you feel the offer is too low.

Pros & Cons of Filing a Roof Damage Insurance Claim

| Pros | Cons |

|---|---|

| Helps cover significant repair or replacement costs | May increase future insurance premiums |

| Provides protection in case of catastrophic damage | Deductibles can reduce the final payout |

| Ensures compliance with local building codes during repairs | Not all types of roof damage are covered |

| Reduces the financial burden of unexpected repairs | Older roofs may receive limited coverage |

FAQs about Roof Damage Coverage

Coverage depends on the cause of the damage and the specifics of your policy. Sudden, accidental damage like storms is often covered.

If the roof was damaged by a covered event (storm, fire, etc.), insurance may cover a full replacement, depending on the policy and roof’s age.

Only if the leak is caused by a covered event like storm damage. Gradual wear and tear are typically not covered.

Some policies may only pay the depreciated value for an old roof, rather than full replacement cost.

Your policy will specify the deductible, which varies depending on the damage type, with separate deductibles often for wind and hail.

Request a detailed explanation, review your policy, and consider filing an appeal with additional documentation.

Filing a claim may increase your premiums, but this depends on the type of claim and your insurance provider’s policies.

Yes, if the tree fell due to a covered event, such as a storm.

Yes, but coverage may vary depending on the material’s age and durability.

Damage due to neglect or lack of maintenance is generally not covered by homeowner's insurance.