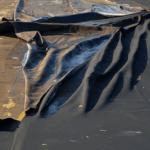

When you discover damage to your roof, whether from a severe storm, falling tree, or another unfortunate event, filing a roof claim with your insurance company seems like the logical next step.

However, one of the most common concerns homeowners in Knoxville, TN, have is, “Will my insurance premium increase if I file a roof claim?”

This question is valid and one that needs careful consideration before deciding to file a claim.

Understanding How Insurance Premiums Work

Insurance premiums are the amount you pay regularly to keep your homeowners insurance policy active. These premiums are calculated based on several factors, including the likelihood of you filing a claim. When you file a claim, your insurance company reassesses your risk level, and this can lead to an increase in your premiums.

Factors That Determine Premium Increases

So, will my insurance premium increase if I file a roof claim? The answer is not straightforward because it depends on various factors:

1.Claim History: If you have a history of filing multiple claims, your insurance company may view you as a high-risk customer, leading to higher premiums.

2.Type of Claim: Not all claims affect your premiums equally. For example, a claim for storm damage may not increase your premiums as much as a claim for negligence or poor maintenance.

3.Severity of the Claim: The cost to repair or replace your roof can influence the decision. A more expensive claim is likely to have a bigger impact on your premiums.

4.Insurance Policy: Some policies include a “claims-free” discount. Filing a claim might cause you to lose this discount, effectively increasing your premium.

How Roof Claims Specifically Impact Premiums

In Knoxville, TN, where storms and severe weather can be common, roof damage is a frequent issue. So,will my insurance premium increase if I file a roof claim? It’s important to note that roof claims are among the most common types of homeowners insurance claims. Therefore, insurance companies might consider roof claims as a regular part of business, and a single claim might not drastically affect your premiums. However, multiple claims over a short period or claims resulting from issues that could have been prevented through regular maintenance might lead to higher premiums.

The Role of Your Deductible

Your deductible is another critical factor to consider. The deductible is the amount you agree to pay out-of-pocket before your insurance covers the rest. If the cost to repair your roof is only slightly higher than your deductible, it might be better to pay for the repairs yourself. This approach could help you avoid the question, “Will my insurance premium increase if I file a roof claim?” by not filing a claim at all.

Benefits of Filing a Roof Claim

When facing roof damage, the decision to file a claim with your insurance company can have significant benefits, especially when the damage is extensive. Let’s delve deeper into the advantages that filing a roof claim can offer:

1. Financial Relief for Costly Repairs

One of the most compelling reasons to file a roof claim is the financial relief it provides. Roof repairs, especially after significant damage from storms or falling debris, can be incredibly expensive. Depending on the extent of the damage, repairs or a full roof replacement can run into thousands of dollars. For many homeowners, covering these costs out-of-pocket isn’t feasible. By filing an insurance claim, you can offset a large portion of these expenses, easing the financial burden.

Mitigating Out-of-Pocket Costs: When you file a claim, your insurance policy can cover the bulk of the repair or replacement costs, minus your deductible. This coverage is particularly valuable in cases where the damage is extensive or if you have a high-quality roof that would be expensive to replace.

Preserving Savings: Utilizing your insurance for roof repairs helps you preserve your savings and emergency funds for other unforeseen expenses, allowing you to maintain financial stability even in the face of unexpected home damage.

2. Professional Repairs Covered by Insurance

Another significant benefit of filing a roof claim is that it ensures professional repairs are carried out under the oversight of your insurance company. This coverage is crucial for maintaining the integrity and safety of your home.

High-Quality Workmanship: Insurance companies typically require that the repairs are performed by licensed and insured contractors. These professionals are experienced in handling a wide range of roofing issues and are familiar with the best practices for repair or replacement. This ensures that your roof is restored to its pre-damage condition or better, providing you with a high-quality repair job.

Use of Quality Materials: When you file a claim, the insurance company often mandates that the repairs are done using materials that meet industry standards. This ensures the longevity and durability of your roof, which is especially important in areas like Knoxville, TN, where weather conditions can be harsh and unpredictable.

Compliance with Local Building Codes: Professional contractors are also knowledgeable about local building codes and regulations. When your roof repairs are covered by insurance, you can be confident that the work will be compliant with these codes, avoiding potential legal issues and ensuring the safety of your home.

3. Peace of Mind Knowing Your Roof is Protected

Perhaps one of the most underrated benefits of filing a roof claim is the peace of mind it brings. Knowing that your roof is in good hands and that the damage will be properly addressed can alleviate a great deal of stress and anxiety.

Restoration of Structural Integrity: A damaged roof can compromise the structural integrity of your home, leading to further issues such as water damage, mold growth, or even structural collapse if not addressed promptly. Filing a claim ensures that these issues are resolved quickly, restoring your home’s safety and protecting your family.

Long-Term Protection: By filing a claim and getting your roof professionally repaired or replaced, you’re investing in the long-term protection of your home. A well-maintained roof not only shields your home from the elements but also preserves its value and enhances its curb appeal.

Insurance Backing: When you file a claim and the repairs are completed under the insurance company’s watchful eye, you have the assurance that any future issues related to the repair will be covered. This insurance backing means that if something goes wrong with the repair, the insurance company may be responsible for further repairs, giving you an additional layer of protection.

Tips to Prevent Premium Increases

If you’re concerned about the possibility of your insurance premiums increasing after filing a roof claim, here are a few tips:

Regular Maintenance: Keep your roof in good condition through regular inspections and maintenance to avoid preventable damage.

Choose a Higher Deductible: Opting for a higher deductible can lower your premium, though you’ll need to pay more out-of-pocket in case of a claim.

Consider a Roof Endorsement: Some insurance companies offer roof endorsements that protect you from premium increases due to roof claims.

FAQs about Filing and Insurance Premiums

It might, but storm-related claims often have less impact on premiums than claims related to neglect.

Yes, multiple claims in a short period can lead to significant premium increases.

If the damage is minor and close to your deductible, it might be wise to pay for repairs yourself.

Yes, areas prone to storms might have higher premiums due to the increased risk of roof damage.

Yes, filing a claim can eliminate this discount, effectively raising your premium.

Paying out-of-pocket for minor repairs or increasing your deductible are potential alternatives.

Coverage depends on your policy; damage due to neglect may not be covered.

Regular maintenance and choosing a higher deductible are effective strategies.

Consider the long-term cost in premium increases versus the short-term gain of coverage.

Older roofs might lead to higher premiums or limited coverage options.

Will My Insurance Premium Increase

So, will my insurance premium increase if I file a roof claim? It depends on various factors, including your claim history, the severity of the claim, and your insurance policy details. By understanding these factors and considering your options carefully, you can make the best decision for your situation in Knoxville, TN.

If you need further advice or a professional inspection to assess your roof’s condition, don’t hesitate to contact a local roofing expert. They can help you navigate the insurance process and ensure your home remains protected without unnecessarily increasing your insurance premiums.

Filing a roof claim, while often seen as a potential trigger for increased premiums, also offers significant benefits that can outweigh the costs. From financial relief and professional repairs to the peace of mind that comes with knowing your home is protected, the advantages of leveraging your insurance for roof repairs are clear. For homeowners in Knoxville, TN, where weather can be unpredictable and sometimes severe, these benefits are particularly relevant. Taking advantage of your insurance coverage when necessary is a smart move to ensure the safety, security, and longevity of your home.