If you’re a homeowner in Knoxville, TN, you may have noticed that your roof deductible is higher than expected. A roof deductible is the amount you pay out of pocket before your insurance covers the rest of the claim. While it can be frustrating to see this figure rise, understanding the factors that influence it can help you make more informed decisions about your home insurance and roofing needs.

What Is a Roof Deductible?

Before diving into why your roof deductible might be higher than anticipated, let’s clarify what a deductible is. A roof deductible is the portion of a claim that the homeowner must pay when they need a roof replacement or major roof repair covered by their homeowner’s insurance. This is typically expressed as either a fixed dollar amount or a percentage of the total coverage of the home.

For example, if your home is insured for $300,000 and you have a 2% deductible, you would pay $6,000 out of pocket before your insurance kicks in. If your roof deductible is $1,500, you’ll need to cover that amount before any insurance payout takes effect for roofing repairs or replacements.

Factors That Influence a High Roof Deductible

There are several reasons why your roof deductible might seem unusually high. Understanding these factors can provide insight into how they are calculated and what options you may have to lower them.

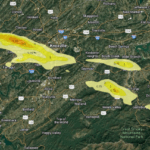

1. Location-Specific Risks (Knoxville, TN)

Your location plays a major role in the size of your roof deductible. Knoxville, TN, experiences its fair share of storms, high winds, and other weather-related events. This means insurers may classify this area as higher-risk, leading to increased premiums and deductibles. Areas prone to frequent roof damage or claims will often see higher roof deductibles as a protective measure for insurance companies.

2. Type of Roof Material

The material of your roof can also influence your roof deductible. High-end materials like metal or tile are more expensive to repair or replace, so insurance companies may charge a higher deductible to offset the potential cost. On the other hand, if your home has a traditional asphalt shingle roof, you might see lower deductibles, although the deductible can still be raised due to other factors.

3. Roof Age and Condition

Older roofs typically have higher deductibles because they are more susceptible to damage. If your roof is nearing the end of its lifespan, it will be more likely to sustain damage from storms or normal wear and tear, making it more expensive to insure. Insurance companies often adjust roof deductibles based on the age and condition of the roof, making it important to keep your roof in good repair.

4. Percentage-Based Deductibles

In recent years, more insurance companies have moved towards percentage-based deductibles, especially for roof damage claims. This means your roof deductible is calculated as a percentage of your home’s overall insured value. While this may seem like a fair way to assess deductibles, it can lead to much higher out-of-pocket costs for homeowners with expensive properties.

For example, if your home is insured for $500,000 and you have a 2% roof deductible, you’ll need to pay $10,000 before insurance will cover any roof-related claims. This can be a shock, especially for homeowners who are more familiar with fixed deductibles that were common in the past.

5. Frequent Insurance Claims

If you’ve filed multiple roof insurance claims in the past, particularly for roof repairs or replacements, your insurance company may raise your roof deductible as a way to discourage future claims. This is especially true if those claims were related to roof damage from storms, as insurance providers want to minimize their financial exposure to frequent roof repairs.

6. High-Risk Roof Types

Certain roof designs or types may be considered higher risk by insurance companies. For example, flat roofs or roofs with poor drainage can lead to more damage and, therefore, higher roof deductibles. Likewise, if your roof has a steep pitch, it could be considered more expensive to repair or replace, which could result in a higher roof deductible.

How to Lower Your Roof Deductible

If you’re facing a high roof deductible, you may wonder if there’s anything you can do to reduce it. The good news is that there are several strategies you can consider to help lower your roof deductible and overall insurance costs.

1. Upgrade Your Roof

One of the most effective ways to lower your roof deductible is by upgrading your roof materials or making sure it is in good condition. Installing impact-resistant materials, like Class 4 shingles, can sometimes earn you discounts or lower your deductible. Insurance companies view durable roofing materials as less likely to incur frequent damage, leading to savings on premiums and deductibles.

2. Shop Around for Insurance

If your current roof deductible is unmanageable, it may be time to shop around for a new insurance provider. Different companies offer various deductible structures, and you might find a better deal by comparing policies. Be sure to ask about options for lowering your roof deductible specifically.

3. Consider a Fixed Deductible Option

Some insurance providers may still offer fixed deductibles for roof damage rather than percentage-based deductibles. While these policies may come with slightly higher premiums, they can save you money in the long run by capping your out-of-pocket expenses at a set amount.

Pros and Cons of Higher Roof Deductibles

| Pros | Cons |

|---|---|

| Lower insurance premiums | Higher out-of-pocket costs in the event of a claim |

| Encourages better home maintenance | Financial burden if roof damage occurs unexpectedly |

| Can be more manageable with an emergency fund | Hard to predict future storm or damage events |

FAQs About Roof Deductibles

Percentage-based deductibles are increasingly common and reflect a percentage of your home’s total insured value.

You can lower your roof deductible by upgrading to impact-resistant materials, shopping for different insurance, or opting for a fixed deductible policy.

Factors like roof age, condition, and frequency of claims can cause your deductible to rise.

No, roof deductibles can vary depending on the cause of the damage and your insurance policy specifics.

No, some companies still offer fixed deductibles, but percentage-based options are becoming more common.

You can discuss deductible options with your insurance agent, but some factors are beyond negotiation.

Yes, different companies offer different deductible structures, so shopping around could result in a lower deductible.

Typically, a higher roof deductible results in lower monthly premiums, but it also means more out-of-pocket expenses during a claim.

If you can't afford your deductible, it could delay necessary repairs, leaving your home vulnerable to further damage.

Get More Info

Understanding why your roof deductible is so high is crucial for managing your home insurance costs effectively. Whether it’s due to the location of your roof in Knoxville, TN, the type of roof material you have, or recent changes in insurance policies, knowing the factors that affect your deductible can help you make informed decisions. By upgrading your roof, shopping for new insurance, or opting for different deductible structures, you can take control of these expenses and ensure your home stays protected.