Homeowner’s insurance is a critical aspect of homeownership, providing financial protection against potential losses due to damage or theft.

One question that often arises among homeowners is whether the age of their roof affects their insurance rates.

In this post, we’ll explore the impact of roof age on homeowner’s insurance and delve into various factors that influence home insurance rates.

Understanding Homeowners Insurance

Homeowner’s insurance is a policy that covers damage to your home and personal property, liability for injuries, and living expenses if your home becomes uninhabitable due to a covered event. It is designed to provide peace of mind by ensuring that you are financially protected against unexpected events like fires, storms, theft, and vandalism. Coverage typically includes:

- Dwelling Coverage: Protects the physical structure of your home.

- Personal Property Coverage: Covers the contents of your home, including furniture, appliances, and personal belongings.

- Liability Coverage: Provides protection if someone is injured on your property or if you cause damage to someone else’s property.

- Additional Living Expenses: Covers the cost of living elsewhere while your home is being repaired after a covered loss.

How Roof Age Affects Homeowner's Insurance

Increased Risk with Older Roofs

The age of your roof is a significant factor that insurers consider when determining your homeowner’s insurance rates. Older roofs are more prone to damage from weather conditions such as heavy rain, hail, and wind. They are also more likely to have wear and tear issues that can lead to leaks and structural problems. Due to these increased risks, insurance companies may charge higher premiums for homes with older roofs. For instance, roofs that are 20 years old or older may see a 10-20% increase in insurance premiums.

Roof Replacement Discounts

On the flip side, having a new roof can lower your insurance premiums. Many insurance companies offer discounts to homeowners who replace their roofs with newer, more durable materials. A new roof is less likely to suffer damage, reducing the likelihood of an insurance claim. This reduced risk translates into lower insurance costs. Some insurers offer discounts ranging from 5% to 20% for new roofs, particularly those made with impact-resistant materials.

Types of Roofing Materials

The type of roofing material also plays a role in insurance rates. For example, metal roofs are more resistant to fire and extreme weather conditions compared to asphalt shingles. As a result, homes with metal roofs may qualify for lower insurance premiums. Conversely, roofs made of less durable materials may attract higher rates due to their increased vulnerability. Here are some common roofing materials and their impact on insurance rates:

– Asphalt Shingles: Common and affordable but may not offer the best protection against severe weather.

– Metal Roofing: Durable and fire-resistant, often resulting in lower premiums.

– Slate or Tile Roofing: Highly durable but expensive to replace, potentially offering moderate premium reductions.

– Wood Shingles: Prone to fire damage, often resulting in higher premiums unless treated with fire-resistant coatings.

Other Factors That Affect Home Insurance Rates

Location

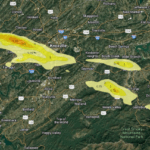

Your home’s location is a primary factor in determining your insurance rates. Homes in areas prone to natural disasters like hurricanes, earthquakes, or floods typically have higher premiums. Additionally, if you live in a high-crime area, your insurance costs may be higher due to the increased risk of theft and vandalism. For example, coastal homes may face higher premiums due to the risk of hurricanes, while homes in tornado-prone regions like the Midwest might also see increased rates.

Claims History

Your personal claims history and the history of claims in your neighborhood can affect your insurance rates. If you have filed multiple claims in the past, insurers may view you as a higher risk and increase your premiums. Similarly, if your neighborhood has a high rate of claims, this can impact your rates. A single claim might increase your premiums by 10-15%, while multiple claims can have an even greater impact.

Home Security and Safety Features

Homes equipped with security systems, smoke detectors, and other safety features often qualify for discounts on insurance premiums. These features reduce the risk of theft and damage, making your home safer and less costly to insure. Installing a monitored security system can reduce premiums by up to 20%, while smoke detectors and fire extinguishers might offer smaller discounts.

Home's Age and Condition

The overall age and condition of your home also influence insurance rates. Older homes may have outdated electrical, plumbing, and heating systems, which can increase the risk of fire or water damage. Insurers often charge higher premiums to cover these risks. Regular maintenance and upgrades can help mitigate these costs. For example, upgrading an old electrical system can reduce fire risk and potentially lower premiums.

Coverage Amount and Deductibles

The amount of coverage you choose and your deductible amount also play a significant role in your insurance costs. Higher coverage limits provide more protection but come with higher premiums. Conversely, opting for a higher deductible can lower your premiums but means you’ll pay more out of pocket if you need to file a claim. For example, increasing your deductible from $500 to $1,000 can reduce your premiums by about 10%.

Pros and Cons of Replacing Your Roof for Insurance Purposes

| Pros | Cons |

|---|---|

| Lower insurance premiums | Upfront cost of roof replacement |

| Increased home value | Potential inconvenience during installation |

| Enhanced home safety | Requires regular maintenance |

| Reduced risk of damage | Dependent on roofing material choice |

| Potential tax benefits | Not all insurers offer discounts |

Pros

- Lower Insurance Premiums: Newer roofs are less likely to suffer damage, reducing the risk for insurers and leading to lower premiums.

- Increased Home Value: A new roof can increase your home’s market value, making it more attractive to buyers.

- Enhanced Home Safety: Modern roofing materials often provide better protection against the elements, enhancing the overall safety of your home.

- Reduced Risk of Damage: New roofs are less prone to leaks and structural issues, reducing the likelihood of costly repairs.

- Potential Tax Benefits: Some states offer tax incentives for energy-efficient roofing materials.

Cons

- Upfront Cost of Roof Replacement: Replacing a roof can be expensive, with costs varying based on materials and labor.

- Potential Inconvenience During Installation: Roof replacement can be disruptive, requiring homeowners to plan for noise and construction.

- Requires Regular Maintenance: Even new roofs need maintenance to ensure longevity and performance.

- Dependent on Roofing Material Choice: The benefits of a new roof can vary depending on the materials used; some materials may not offer significant insurance discounts.

- Not All Insurers Offer Discounts: While many insurers provide discounts for new roofs, it’s important to confirm this with your insurance provider.

Web Ratings

Below is a table summarizing how different factors impact homeowner’s insurance rates based on data from various sources:

| Factor | Impact on Rates | Source |

|---|---|---|

| Roof Age | 10-20% increase for roofs over 20 years old | Insurance Journal |

| Location | Up to 30% higher in disaster-prone areas | NAIC |

| Home's Age | 15-25% higher for homes over 30 years old | Zillow |

| Claims History | 10-15% increase for multiple claims | Insurance.com |

| Coverage Amount | 5-10% increase for higher coverage | Allstate |

| Security Features | 5-20% discount | State Farm |

FAQs about Age of Roof and Homeowner’s Insurance

Older roofs are more prone to damage and leaks, increasing the likelihood of a claim, which in turn raises your premiums. Insurance companies view older roofs as a higher risk, and therefore charge more to cover potential damages.

Yes, many insurers offer discounts for new roofs made from durable materials. These discounts can range from 5% to 20%, depending on the roofing material and the insurer's policies.

Metal roofs are often preferred for their durability and resistance to fire and extreme weather. Other materials like slate or tile can also offer benefits but may not be as cost-effective as metal.

Yes, older homes or homes in poor condition typically have higher premiums due to increased risk of damage. Regular maintenance and upgrades can help reduce these costs.

Homes in areas prone to natural disasters or high crime rates generally have higher premiums. Insurers charge more to cover the increased risk associated with these locations.

Yes, security features like alarms and smoke detectors can qualify you for discounts. Monitored security systems, in particular, can significantly reduce premiums.

Frequent claims can lead to higher premiums as insurers consider you a higher risk. It's important to manage claims wisely and avoid filing minor claims that could impact your rates.

A higher deductible can lower your premiums but means higher out-of-pocket costs if you file a claim. It's a trade-off between lower monthly costs and potential expenses in the event of a claim.

Yes, insurers often provide discounts for homes with newer, more durable roofs. These discounts can vary but are generally aimed at reducing the risk of damage.

Yes, maintaining your home can prevent damage and reduce the likelihood of claims, potentially lowering your premiums. Regular inspections and timely repairs are crucial for keeping insurance costs down.

Age of Roof - Effects on Homeowner’s Insurance

The age of your roof is a crucial factor in determining your homeowner’s insurance rates. Older roofs pose a higher risk and can lead to increased premiums, while new, durable roofs can help lower your costs. However, roof age is just one of many factors that influence your insurance rates. Your home’s location, age, condition, claims history, coverage amount, and security features all play significant roles. By understanding these factors and making informed decisions, you can effectively manage your homeowner’s insurance costs. If you have any further questions or need personalized advice, it’s always best to consult with your insurance provider.