Severe weather is no stranger to Knoxville, TN, and neither is roof damage. In 2023 alone, the area was hit by multiple hailstorms and high winds, causing widespread property damage. But here’s the kicker: most homeowners never receive the full insurance payout they deserve — and often don’t even realize it.

That’s where a public adjuster for roof damage comes in. These licensed professionals work for YOU, not the insurance company, ensuring your claim is fairly evaluated and properly paid out.

Whether you’ve recently experienced storm damage or are still dealing with an unresolved insurance claim, this article will show you exactly why hiring a public adjuster can be the smartest move for your roof — and how Litespeed Construction can help every step of the way.

Key Takeaways

| Benefit | Why It Matters in Knoxville |

|---|---|

| Higher Claim Payouts | Public adjusters get 200–700% more than initial offers |

| No Upfront Cost | Paid only when you get paid — no risk for homeowners |

| Faster, Hassle-Free Claims | Avoid confusion and paperwork overload |

| Detailed Damage Reports | Infrared, drone, attic moisture — they document it all |

| Peace of Mind | You get a licensed advocate who knows your rights |

What Is a Public Adjuster, Exactly?

A public adjuster is a state-licensed insurance professional hired by homeowners to manage and negotiate insurance claims. Unlike insurance company adjusters (who work for the insurer), public adjusters work for you, the policyholder.

Their job is to:

- Evaluate roof and property damage

- Interpret your insurance policy

- Prepare and file the claim

- Negotiate directly with the insurance company

- Maximize your payout

📌 In Tennessee, public adjusters must:

- Pass a state licensing exam

- Maintain a $50,000 surety bond

- Undergo background checks and continuing education

🔗 Learn more about public adjuster licensing at the Tennessee Department of Commerce & Insurance

Knoxville Storm Damage & Insurance Realities

With frequent hail, high winds, ice, and thunderstorms, Knoxville homes are at constant risk for roof damage.

📊 Local Storm Statistics (Knoxville, TN)

| Weather Type | Annual Frequency | Roof Impact |

|---|---|---|

| Hail (1” or larger) | 5–7 per year | Granule loss, cracked shingles |

| Windstorms (>60 mph) | 4–6 per year | Shingle uplift, flashing failure |

| Torrential Rain | 12+ per year | Water leaks, underlayment saturation |

| Ice/Snow Events | 2–3 per year | Ice dams, gutter damage |

🧠 Local Insight: In March 2023, a hailstorm caused over $2.5 million in damage across Knox County. Many homeowners were underpaid — or denied — because they didn’t know what their policy covered.

Why Insurance Claims Often Fall Short

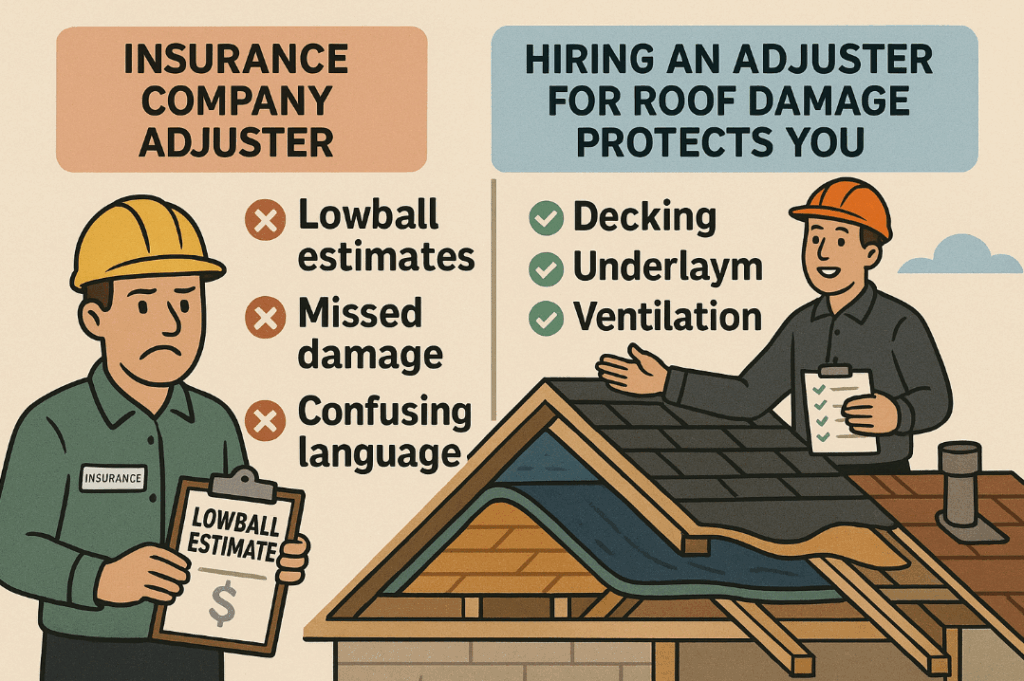

Insurance company adjusters work in the best interest of the insurer, which can lead to:

- Lowball estimates that don’t cover full repairs

- Missed damage, especially to hidden layers of the roof

- Confusion over policy language (e.g. exclusions, deductibles, depreciation)

Hiring an adjuster for roof damage protects you from these pitfalls and ensures your entire roofing system — decking, underlayment, ventilation, and more — is accounted for.

🔝 Top 5 Benefits of Using a Public Adjuster for Roof Damage

1. ✅ Higher Insurance Payouts

Hiring a public adjuster can significantly increase your roof insurance claim payout — especially after major storm events common in East Tennessee.

In 2022, the Tennessee Department of Commerce & Insurance (TDCI) helped secure $11.5 million for Tennessee policyholders by mediating their complaints against insurance companies. These mediations resulted in many denied claims being overturned or led to additional payments for consumers.

📌 What that means for you: Having a licensed adjuster for roof damage on your side often leads to larger, more accurate settlements than if you go it alone.

📊 Tennessee Roof Claim Scenario:

A homeowner in West Knoxville was offered $7,200 by their insurance company after hail damage. After involving a public adjuster (recommended by Litespeed Construction), the final claim was settled at $21,500 — enough to fully replace the roof to code with upgraded materials.

🧠 Key Insight: Tennessee homeowners have a right to dispute claim values — and public adjusters are experts in doing that effectively and legally.

2. 🧾 No Upfront Cost — Risk-Free Help

Most public adjusters work on contingency, meaning they only get paid when you do. Standard rates are 10–20% of the final claim payout.

Example:

| Claim Payout | Adjuster Fee (15%) | Net to You |

|---|---|---|

| $10,000 | $1,500 | $8,500 |

| $25,000 | $3,750 | $21,250 |

📌 Considering that they may increase your payout by 200–700%, this cost is well worth the investment.

3. ⏱️ Time-Saving & Hassle-Free Process

Filing a roof claim can involve:

- Photos

- Measurements

- Statements

- Damage documentation

- Endless follow-ups

With an adjuster for roof damage, all of this is handled for you.

You focus on your home — they focus on your claim.

🔗 Need help with a storm claim? Litespeed Construction can connect you with a trusted local adjuster.

4. 📷 Comprehensive & Accurate Damage Reports

Public adjusters use:

- Drone imaging

- Thermal cameras

- Moisture detection meters

- Interior attic inspections

They also include code upgrade requirements and matching laws.

📌 Tennessee’s Matching Law (§ 56-7-111) ensures that entire roofs can be replaced if matching materials are unavailable — something many insurers don’t mention.

5. 🛡️ Peace of Mind With Local, Licensed Advocates

Hiring a local adjuster for roof damage means:

- They understand Knoxville’s weather patterns

- Know local contractors and roofers

- Understand Tennessee building codes

Plus, Litespeed Construction works with adjusters who are:

- State-licensed

- Ethically bonded

- Experienced in Knoxville insurance battles

Additional Questions to Ask Before Hiring a Public Adjuster

- Are you licensed in Tennessee?

- Do you have experience with roof damage claims specifically?

- Can you provide Knoxville-based references?

- What’s your fee and when is it due?

- How will you coordinate with my roofing contractor?

✅ Pros & Cons at a Glance

| Pros | Cons |

|---|---|

| Much higher insurance payouts | They take a % of your claim |

| Professional claim documentation | Vetting is required |

| No upfront cost — contingency pay | May extend timeline slightly |

| Avoids stress and confusion | Not needed for very small claims |

| Licensed advocates for your rights | Some insurers push back initially |

FAQs about Hiring a Public Adjuster for Roof Claims

Yes — they must be licensed by the state and bonded for a minimum of $50,000.

Absolutely. We can inspect your roof and help coordinate with a trusted adjuster.

Yes. Many claims can be appealed or reopened with stronger documentation.

Within 24–72 hours is best, but even weeks or months later, an inspection can still uncover valid damage.

It can range from $7,000–$20,000+, depending on size, materials, and scope — that’s why maximizing your claim matters!

📞 Need Help with Roof Damage Insurance? Start with Litespeed Construction

At Litespeed Construction, we understand how frustrating roof damage and insurance claims can be. We work with homeowners throughout Knoxville to:

✅ Inspect your roof for FREE

✅ Document all storm or hail damage

✅ Connect you with a trusted public adjuster for roof damage

✅ Handle everything until your roof is fully repaired or replaced

👉 Schedule Your Free Roof Inspection Now

📞 Or call: (865) 297-3286

🛑 Don’t accept a lowball offer. Let us and a licensed adjuster fight for what you’re owed.